18 Dec 2023

My 2023: An impactful year with reasons to be optimistic as we head into 2024

Looking ahead toward the new year feels different this time. One reason is that I’m recovering from being hit by, and then thrown over, a car last month – and such trauma tends to repaint one’s world in surprisingly vibrant hues.

The other reason is equally novel for me at least: the tectonic plates that formed the foundations of our industry have begun to liquify.

Of course, year after year, the tools have changed, the cycles turned, requirements like T+3 reduced to T+2 (which shortens to T+1 in May)… plus ça change. But 2024 will be different, because the field our game is played on is transforming more profoundly than ever before. Trading, post-trade, ops, research, marketing, sales – the engines that make up a securities finance business – they are all going to be enhanced by Generative Pre-Trained Transformers, like everyone’s favourite AI assistant, ChatGPT, and AI-powered tools, like Microsoft CoPilot.

The Pirum way

We at Pirum are excited about this shift. Ever since we set out to automate the full post-trade lifecycle for securities finance and collateral management, Pirum has sought to improve efficiency, bring clarity and foster collaboration by upgrading the entire way we do business.

To paraphrase Henry Ford, we were never about selling faster horses; Pirum’s sights were always firmly on automating the concept of mobility itself. And I am pleased to report that Pirum has this year arrived at an all-encompassing, digital equivalent to the Model T assembly line: a single user-centric solution that covers the post-trade lifecycle.

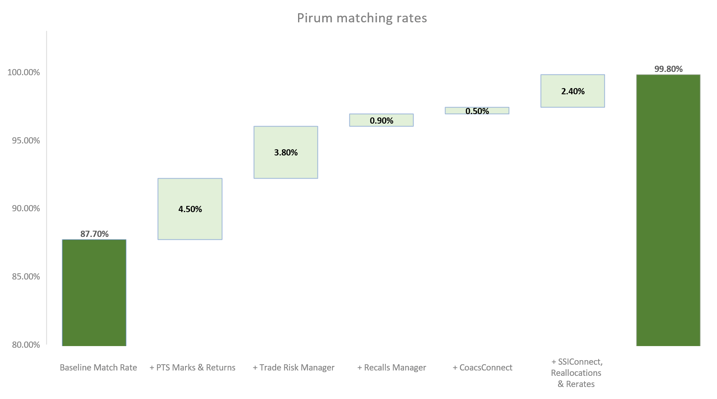

The stats speak for themselves. Once we roll out our upcoming features in early 2024, the Pirum post-trade platform will reach an industry leading 99.8% matching rate. From regulatory reporting to recalls, to breaks, to collateral management, and so on, Pirum takes care of the whole nine yards.

In achieving this we’ve adopted state-of-the-art technology. But, more importantly, we’ve arrived at this inflection point in the automation of our industry through close collaboration with our clients, as well as industry bodies like ICMA, ISLA, RMA, CASLA, and PASLA

The proof is in the pudding

And the fruits of all this work? To name a few: reductions in fails and penalties, improved regulatory compliance, reduced operational burdens, and significantly boosted profits. We have heard from our clients how Pirum has transformed their budgets: their ROI (which we have regularly seen reach tenfold returns) has been successfully invested in people, R&D on new products, and other profitable endeavors.

I want to therefore use this opportunity to invite all industry players into this movement. To join Pirum in upgrading the piping of the securities finance (Repo, SBL and TRS) industries. Just like Microsoft CoPilot will transform how companies create reports, sales decks, and code, our solution offers a best-in-class, one-stop-shop, and future-proofed foundation for SBL and repo. A foundation upon which we, as an industry, can build even further and higher, incorporating DLT and other digitally fuelled future enablers.

So, if you’re wondering how the next iteration of our industry will flow, get in touch. I guarantee that you will see things anew – creating more time, more resource, more budget, more clarity and certainty, and more data to make better-informed decisions. In short, a more stable, productive, and profitable business.

As Benjamin Franklin put it: “An investment in knowledge pays the best interest.” That said, now is the time to rest and spend time with our family, friends, and loved ones. Season’s Greetings to you all, stay safe on those dark roads – and let’s talk in the new year.

Phil Morgan, CEO

.png?width=804&height=182&name=PIRUM25_website%20logo%20(002).png)