23 Apr 2024

How to untangle the €6.7 trillion manual-based European repo market

Jon Ford, Head of Fixed Income Business Development

Spot the difference?

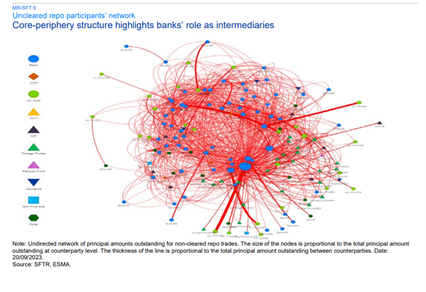

Whilst reading ESMA’s latest report, EU Securities Financing Transactions markets 2024, I was struck by the similarities between Jackson Pollack’s drip painting No 31 and the buzzing European Repo Market.

Jackson Pollock Number 31 (1949) – $45mm

European repo market 2024 – €6.7 trillion

Nevermind that the cost of fails in the market could buy a dozen Pollack’s, looking at this beautiful mess, William James’ description of consciousness before it achieves rationality came to mind. Our market certainly looked ‘blooming’ and ‘buzzing’, and it was certainly ‘confusing’ in its unstructured beauty.

The report added weight to this thought, given the stats:

- 4,000 legal entities

- 329,000 average transactions

At a 98% settlement rate could it be that average daily fails are in the thousands? Answer: Yes.

It was the clearest representation I’d seen for how, before we even start on each node’s internal structures and processes, the market structure itself is crying out for standardization, for digitization, for automation and dare I say, untangling.

Detangling a gordian knot

So, how do we create order from all this chaos? We automate! For a myriad of reasons, and often at no fault of individual players, securities finance has held the mantle of laggard, when it comes to financial services reaping the fruits of exception-based automation and real-time digital communication. Regulators have noticed!

And within securities finance – this collaborative, always busy, and trustworthy global community I love to work in – the repo market has historically been slow to modernize. But in the day of Quant trading, AI, Open Banking, instant messaging, machine learning, globally connected and (in practice) 24hr markets, Pirum can help every player jump up to speed.

Our answer: RepoConnect. This cutting-edge and fully automated, digitized, and up to 99.8% STP solution:

- Affirms in real-time to reduce fails

- Pairs off transactions to reduce settlements issues

- Connects you to $1.5 trillion in client flow

- Covers the entire repo desk post-trade lifecycle

- Centralize communication and be done with chats and emails

The bottom line

From a micro POV: in the current Pollock-like European repo market, a single fail over a weekend can run into the tens if not hundreds of thousands of pounds, dollars or Euros – the time to automate was yesterday.

From a macro POV: the more nodes adopt our proven technology, the quicker the entire spaghetti dish would transform into something more akin to a neural network. Orderly. Efficient. Flexible. Transparent. Scalable.

For so many industries, automation has delivered: workflows optimized, bottlenecks identified and eliminated, transparency increased, wastage reduced (time and resource). From health care, electronics, retail, pharmaceuticals, automotive, banking – the list goes on. The Repo Automation train has left the station… are you on board?